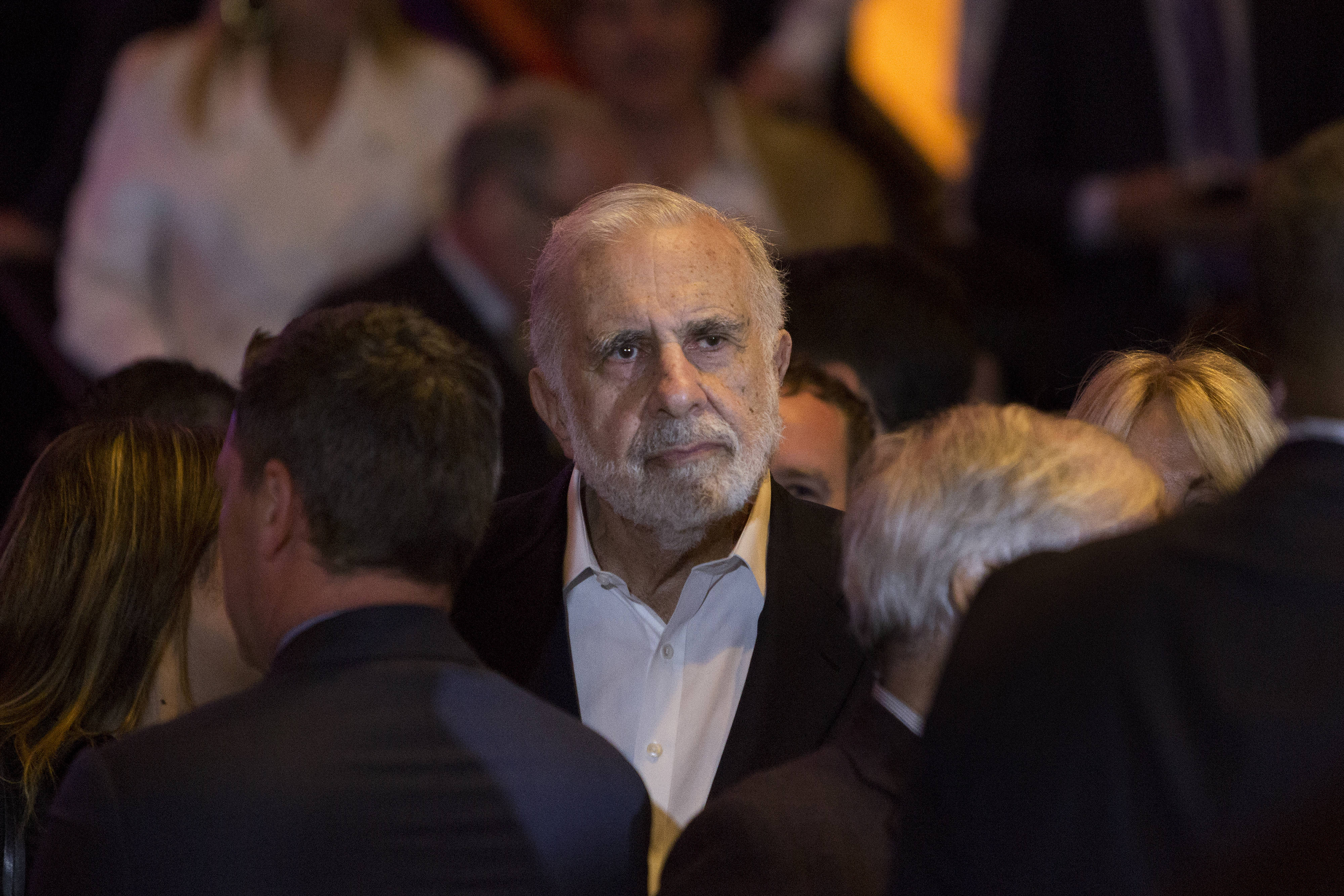

Carl Icahn, billionaire activist investor, waits for Donald Trump, president and chief executive of Trump Organization Inc. and 2016 Republican presidential candidate, not pictured, to speak at an election night event in New York, U.S., on Tuesday, April 19, 2016.

Victor J. Blue | Bloomberg | Getty Images

Billionaire investor Carl Icahn is moving his office from New York to Florida early next year, and plans to eventually hand over the hedge fund to his son, Brett.

The 83-year-old activist hedge fund manager, who founded Icahn Enterprises, has no plans to retire, but told The Wall Street Journal that his son is the “leading candidate” to take over his firm.

“I’m not going to give up making the real decisions,” Icahn said. “I’m still in charge, but he’d get a piece of the action.”

Brett, 40, would likely rejoin the company in the next few months after a more than three-year break, and would oversee a small new investment fund. For over a year, Icahn and his son have been negotiating the terms of the agreement, leading to a roughly 90-page contract, according to The Journal.

“I don’t think anybody can fill his shoes the way he fills them,” Brett said. “But I look forward to continuing to make him a lot of money and continuing to develop my career.”

Brett worked with his father for over 15 years as an analyst, but recently took a break. He remained involved as a consultant and now represents his father on the board of Newell Brands Inc., the maker of Sharpies and other products. He previously ran a more than $6 billion fund at Icahn Enterprises.

After joining Icahn Enterprises, Brett steered the firm toward profitable investments like one in Apple. Icahn said he wouldn’t have considered that investment because it lacked an activism angle.

“The activism formula is a great formula for increasing shareholder value. My father has proven that,” Brett said. “But I don’t think you absolutely need to have activism for there to be a good risk-reward ratio in an investment.”

At the new fund, Brett would need to put a percentage of his own money into every investment, and is thinking about buying $25 million worth of Icahn Enterprises shares.

Icahn, whose personal wealth is estimated at $17.5 billion, employs roughly 50 people in New York. More than half of his staff, including some of his lawyers and portfolio analysts, will move to the new office near Miami.

Icahn has long told associates that work excites him and he has no plans to stop.