Tuesday the bulls stomped and snorted their way into a 1% rally and the CBOE Volatility Index (VIX) fell 7% to an astonishing 13.5. This in itself is not that shocking, but considering the headline threats that still loom, the bulls are showing wimpish conviction.

Perhaps the earnings so far from the like of JPMorgan (NYSE:JPM) and United Airlines (NASDAQ:UAL) have given investors on Wall Street some courage. Or perhaps the extra relief came from Europe as even there the rhetoric over Brexit has tempered. Regardless, the price action patterns are unfolding according to predictable technical patterns. So maybe in the end, most headlines don’t matter much. They are mere catalysts to trigger the inevitable patterns — but nothing more.

We will get to test this theory when Netflix (NASDAQ:NFLX) reports today. This one company has the potential to cause a sympathy trade in the FANG — Facebook (NASDAQ:FB), Apple (NASDAQ:AAPL), Netflix and Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) — gang and thereby move half the Nasdaq Composite. I fear for NFLX if management falters, especially on the global signup growth front. We could have a repeat of its last earnings disaster trade.

This morning the Dow Jones Industrial Average, S&P 500 and Nasdaq Composite futures are down a bit by 0.2%-0.3%. But for now, the buyers are still in control.

In the options pit Tuesday there were 19.7 million calls and only 15.7 million puts. So for now, optimism is still alive.

On the other hand, the CBOE single-session equity put/call volume ratio yesterday was 0.61. This is still below the 10-day moving average. This means investors are still a bit weary and not all in.

Options trading was abuzz in a handful of stocks like UnitedHealth (NYSE:UNH), Goldman Sachs (NYSE:GS) and Roku (NASDAQ:ROKU).

Here is a better look.

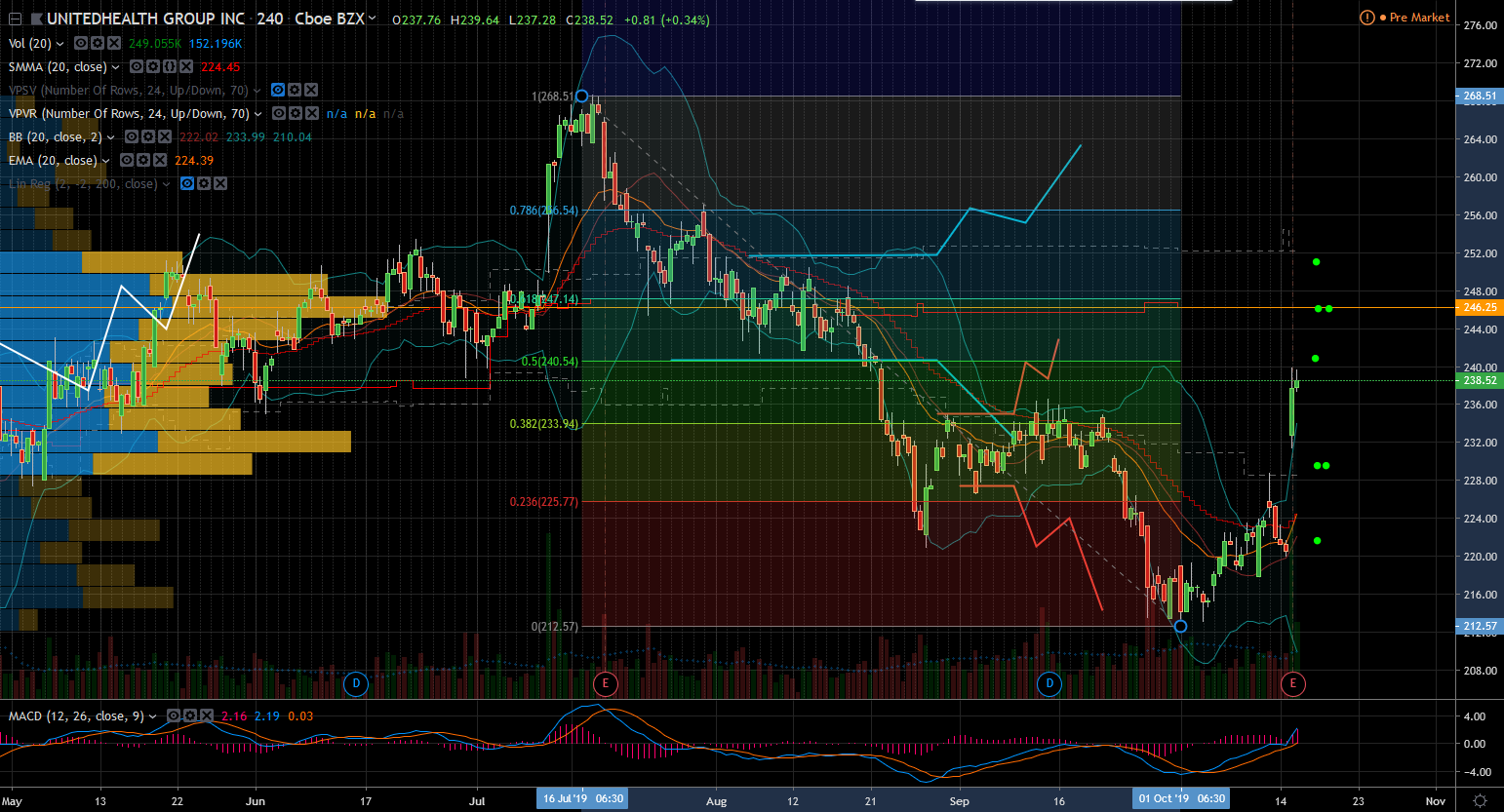

UnitedHealth (UNH)

UNH stock is lagging this year but yesterday it made headlines. The stock rallied over 8% on a positive reaction to earnings. Management beat expectations and more importantly, gave good forward guidance. Although the stock is fundamentally cheap, it is not the time to start chasing it here. Technically it has a tough slog ahead.

If I already own the shares then I could hang on to them as part of my thesis. But short term, this massive rally brings it back into the accident scene from Aug. 22. These ledges tend to be resistance because those who were stuck long into the dip would probably want to get out whole.

UNH stock is also now just below the 50% Fibonacci retracement level. Those too can be resistance. From here the onus is on the buyers to continue this rally. The better place to buy UNH shares would at least be above $241 per share. I’d rather miss a few bucks than buy it too soon. Besides, the earnings pops now left a giant open gap below to $221 per share. Eventually these gaps in trading like to get filled. You could buy to trade if the UNH bulls can hold above $230 per share. Then they would have a shot at breaching the resistance above.

Goldman Sachs (GS)

The banks have had a bad reputation that they can’t rally or that they can’t hold their greens. But of late this is more fallacy than reality. GS stock is up more than the S&P 500 this year. Nevertheless, some bank stocks are momentum stocks and GS is one of them. Management reported earnings last night and after investors threw a fit, they reversed course and GS rallied hard. Today it looks like it wants to add to this rally — so the opportunity lies here.

If GS stock buyers can close above the $207 per share zone they can trigger a rally to target $214. It won’t be easy because they first have to take out yesterday’s high at $208.30 and then push through the 50% Fibonacci retracement level of the 12% correction that started on Sept. 13. Meaning, while the opportunity is there, I consider it a trade so I don’t turn it into an investment. GS is the one bank that could end up having skeletons in its closets. Since the Tuesday selloff failed emphatically, I could also sell puts or put spreads to finance the upside opportunity.

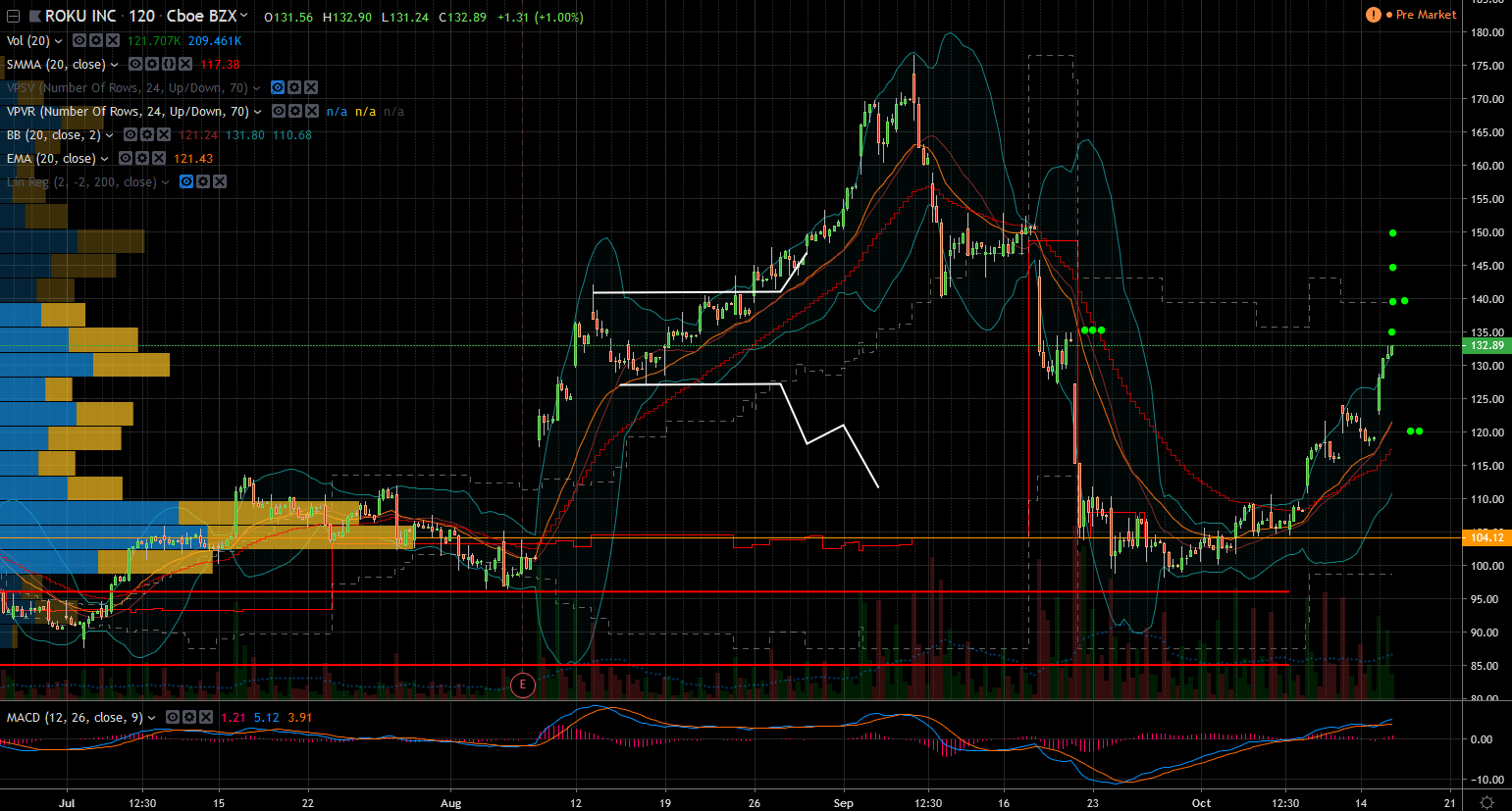

Roku (ROKU)

ROKU stock has had a recent correction as it fell 44% from its $176 per share high in late August. But even so, it is still a star up 333% year-to-date, which is 15 times better than the S&P 500. So the ROKU bears don’t have a lot of room to celebrate. Although I am not a fan of the company’s business model, I don’t try to short its thesis, because if the bulls are correct then it has a lot of potential.

Fundamentally Roku is not impressive given it’s been in business for over 15 years. But perhaps now the fact that NFLX set the stage for a world that wants to stream its content, ROKU can really blossom. Nevertheless, the stock still has a lot of froth it can shed if the selling persists.

Technically, ROKU stock found footing at $100 per share and has since rallied 35%. But this is not the time to jump back on board. I’d rather miss the next few bucks of profit so I don’t buy the fade. While there is no evidence of a huge imminent disaster looming, it has now hit the 50% retracement of the correction. This is a natural zone of resistance so getting here was much easier than plowing through it.

Moreover, the one-hour chart clearly shows how at $134 per share, ROKU stock is back at a huge ledge from Sept. 19. Those ledges are usually resistance until the bulls can prove otherwise. A better entry for a trade in ROKU would be to buy it closer to $119 per share. If not, I’d buy the breakout above $135.

In any of these three situations I have to divest my emotions from the trades. Nothing noted here is to speak against the companies’ fundamentals. It is important to note the unusual activity then learn the levels that matter in the short term.

Nicolas Chahine is the managing director of SellSpreads.com. As of this writing, he did not hold a position in any of the aforementioned securities. Join his live chat room for free here.