High-yield stocks with low price-to-earnings ratios tend to do well over time. It’s also a good deal for investors when the earnings of the company are significantly higher than the dividends paid out. This allows the company to grow its dividends even further.

Beating these averages on a single basis is not that hard. But using all three criteria, it is difficult. The average dividend yield of the S&P 500 is 1.9%. The average dividend payout ratio (dividends per share divided by earnings per share) is 35%. The median P/E ratio of the S&P 500 is 14.8 times.

So finding high-yield stocks that have all three traits is actually not that easy. Part of the reason is that most high-yield stocks also tend to have high payout ratios. Their high yields may signal the fact that the market thinks that earnings do not cover the dividends. The fear is that the company will have to cut the dividend in the future.

But I have chosen five stocks selling with dividend yields of 6%+ and with low payout ratios. The dividends of these stocks represent just 50% or so of earnings per share on a forward-looking basis. This is slightly higher than the average payout ratio of the S&P 500. But this is much better than typical high-yield stocks that have very high payout ratios. In addition, the dividend yields are three times higher than the average.

In addition, these high-yield stocks have low P/E ratios, significantly below the average.

These high-yield stocks are cheap and worth investing in over the long term. You can rely on them to continue to pay their dividends. Also, you get paid with these high-yield stocks to wait until the stock price rises.

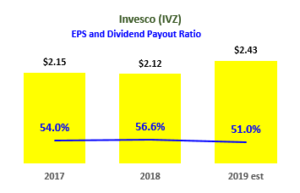

High-Yield Stocks: Invesco (IVZ)

Dividend Yield: 8%

Payout Ratio: 51%

P/E Ratio: 6.4

Invesco (NYS:IVZ) is an investment manager based in Atlanta, Georgia. As of Sept. 30 its assets under management were $1,184 billion — over $1.1 trillion.

IVZ stock trades at a low price-to-earnings ratio of 6.4 — based on my calculations — and is a very high-yield stock. IVZ pays out about half its earnings in dividends.

The market has priced IVZ stock cheaply based on the flow of funds fears. Investors have been worried about the long-term outflow of funds from active investment managers like IVZ. Nevertheless, Invesco has had consistently higher AUM over each of the past 10 years.

IVZ’s dividends have been growing consistently over the past three years (+34%) and five years (+7%). Moreover, its payout ratio has been consistently between 50%-55% of its earnings.

Look for IVZ stock to follow this consistent trend. IVZ has raised its dividend for 11 years. IVZ’s dividends have plenty of room to grow given its low payout ratio history.

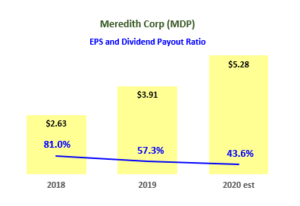

Meredith Corporation (MDP)

Dividend Yield: 7%

Payout Ratio: 43.6%

P/E Ratio: 6.2

Meredith Corporation (NYSE:MDP) publishes People, In-Style, Better Homes and Gardens and Martha Stewart Living. In 2018 MDP also bought Time Magazine. It also owns 17 TV stations. Meredith Corporation is recognized as the number-one magazine operator in the U.S.

MDP stock is very cheap at just 6.2 times forward earnings.

Moreover, its $2.30 dividend rate is only 43.6% of projected earnings. That is a very low payout ratio. It allows room for MDP to continue to raise its dividend.

The chart above shows that its payout ratio has been consistently low. This has allowed MDP to raise its dividend over the past 26 years.

Concerns about the company’s weak earnings outlook and missed expectations have kept MDP stock cheap. Despite underperforming growth expectations, MDP stock continues to offer a high dividend yield, low P/E and low payout ratio. This is the kind of formula to which value investors are very attracted.

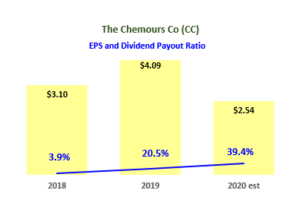

The Chemours Company (CC)

Dividend Yield: 7.5%

Payout Ratio: 39.4%

P/E Ratio: 5.3

Chemours (NYSE:CC) is a specialized chemical company that makes products like refrigerants, fire suppression chemicals and titanium dioxide.

CC stock was spun off from Dow (NYSE:DOW) in 2015. Right now CC stock has a 7.5% dividend yield. But earnings are over twice its dividend rate. The payout ratio is only 39%.

Given the market’s concern about Chemour’s cyclical nature and its potential legal liabilities, the CC stock trades for just 5.3 times forward earnings expectations. Analysts note that most of the environmental liability issues have been settled. But CC stock still has a residual cheapness related to these concerns.

Again, value investors are attracted to these kinds of unloved stocks. The low payout ratio allows room for the dividend to be increased over time. In the past two years, dividends have risen by over 47%. Investors get paid a high yield while they wait for CC stock to rise.

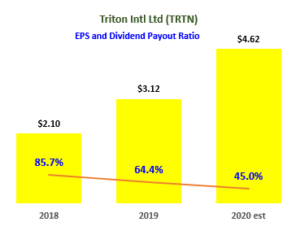

Triton International (TRTN)

Dividend Yield: 6.3%

Payout Ratio: 45%

P/E Ratio: 7.2

Triton International (NYSE:TRTN) is the largest transportation leasing and equipment rental company in the U.S. — it mostly leases intermodal shipping containers.

TRTN stock has a high dividend of 6.3%, but its dividends only account for 45% of earnings. The stock is also cheap since its forward P/E ratio is just 7.2 times. The stock is a general play on international economic growth.

TRTN stock is cheap now because of concerns about the effect of the U.S.-China trade war on its future growth. However, a minor amount of containers are dedicated to U.S-China trade.

Given that analysts expect earnings to be $4.62 this year, its P/E ratio is just 7.2 times forward earnings. Moreover, the $2.08 dividend, up 11.7% from the $1.80 rate last year, represents just 45% of its earnings. There is plenty of room for the TRTN stock dividend to rise. Meanwhile, investors receive high-yield dividends until the stock rises to its real value.

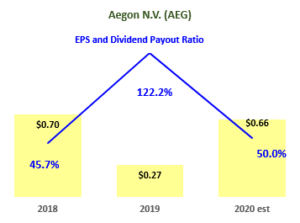

Aegon (AEG)

Dividend Yield: 8.3%

Payout Ratio: 50%

P/E Ratio: 14.1

Aegon (NYSE:AEG) is a Dutch insurance company, pension manager and asset management firm. AEG stock pays a very healthy dividend of 8.3%. But its dividend is just 50% of its earnings.

There is really no good reason for AEG stock to be so cheap. Its return on equity is about 10%. Yet AEG stock, at $4.20, trades for just 32% of its $13.54 book value per share.

Investors can wait for the stock to recognize this incredible value. In the meantime they receive a high 8.9% dividend yield. Annualized growth over the last three years is 6.8%.

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here. The Guide focuses on high total yield value stocks, which includes both dividend and buyback yields. In addition, subscribers a two-week free trial.