An increase in tariffs and an inverted yield curve have led to several warning signs for a slowdown, or even a recession, in the economy. Amazon (NASDAQ:AMZN) has already proved able to survive the dot-com crash and the Great Recession. However, this is a completely different company from a decade ago. Can it still stand tall?

Short answer? Yes. The revenue base is more diversified which gives the company a better position in any future recession. This makes Amazon stock a good defensive bet in case of a short-term slowdown or recession.

Amazon reported subscription revenue of $16.5 billion in the last 12 months. The Prime membership retention rate is also in the high 90’s for customers using this subscription for over two years. A recession could cause a hit on the growth rate of Amazon. However, there are a number of reasons why Amazon should be able to sail through any macro-economic headwinds.

Impact Of Recession On AWS

To gauge the impact of a recession on Amazon stock, we need to look at the possible performance of three major segments.

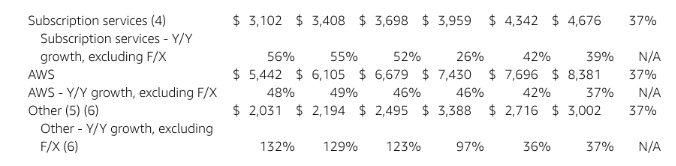

AMZN stock’s ability to manage an economic slowdown depends on its AWS, subscription and advertising segments. Collectively, these three segments reported $16 billion in net sales in the latest quarter out of a total net sales of $63.4 billion.

Source: Amazon Filing

Amazon has built an enviable cash cow in AWS, with revenue of $8.4 billion in the recent quarter. The operating income in AWS stood at $2.1 billion in the latest quarter. In the trailing 12 months, AWS segment reported $30 billion in net sales. This segment can see a slowdown during a recession as major clients curtail their cloud investments.

Amazon has been using the profits from this segment to build other higher growth segments like streaming content and faster delivery. Any slowdown in operating income growth in AWS would automatically limit the company’s ability to invest in other segments. However, it is unlikely that AWS would lose its market share in a slowdown due to economies of scale and a leadership position in this segment.

Will Amazon Stock’s Subscription Revenues Decline?

Amazon has also reported strong growth in subscription revenues. The Prime membership base now stands at over 100 million according to a CIRP report. The retention rate for customers with Prime membership over one-year-old is 93% while this number jumps to 98% for customers with membership older than 2 years. This shows the strong loyalty built by Amazon.

In an economic slowdown, customers try to reduce their discretionary spending. Subscriptions will be the first items to be removed from a customers budget. However, Amazon’s Prime has been built to increase the value proposition for customers. Its value will increase during a slowdown as customers can opt to use more services from Prime and forego other options.

An ideal example is Prime Video. Customers can remove their cable bills and Netflix subscriptions to get their content requirement from Prime. Prime Video has been built as a good enough alternative. In an economic slowdown, Prime members could choose Amazon’s streaming video service without other streaming services to limit their discretionary spending.

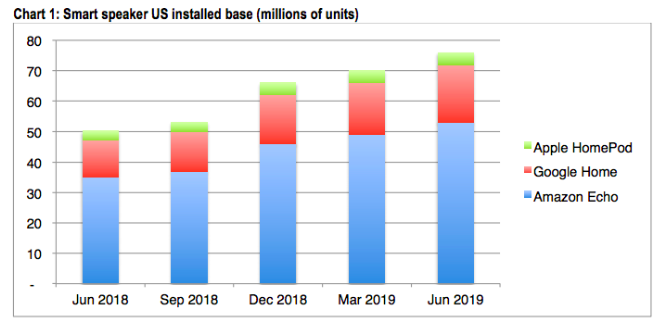

Source: CIRP

The rapid growth of Echo devices has also helped in improving Amazon’s moat in streaming services. Customers can get unlimited music streaming for as low as $3.99 if they use it on only Echo devices. This is 60% less than Apple’s (NASDAQ:AAPL) and Spotify’s (NYSE:SPOT) music services. During an economic slowdown, we should see more users gravitate towards the cheaper options provided by Amazon.

Amazon has a lot of pricing flexibility in its retail platform. This can allow Amazon to sacrifice margins in order to retain customers and Prime subscribers during a recession.

AMZN Stock’s Highly Profitable Advertising

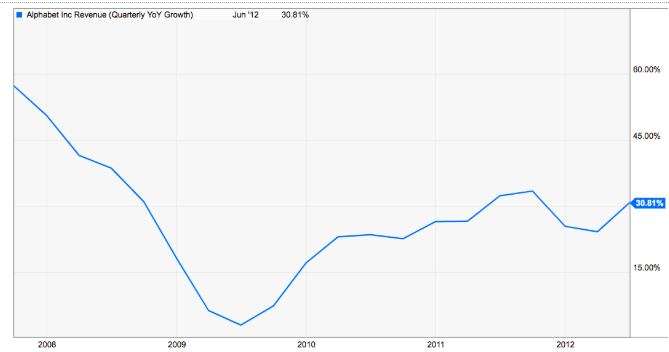

Amazon has built a very successful advertising platform which generated close to $3 billion in the recent quarter. This is a high margin business that is dependent on the growth of Amazon’s retail platform. However, during a recession, many online advertisers can limit their advertising budget. We saw this happen during the Great Recession in 2008-09, when Alphabet’s (NASDAQ:GOOG, NASDAQ:GOOGL) Google saw a big decline in its revenue growth. For three consecutive quarters, Google reported single-digit growth in revenue as advertisers cut back on their online spending.

Fig: Google’s dip in revenue growth at the peak of the last recession

Amazon could face a similar decline, which will limit the revenue from this highly profitable segment.

Diversification Is the Key For Amazon Stock

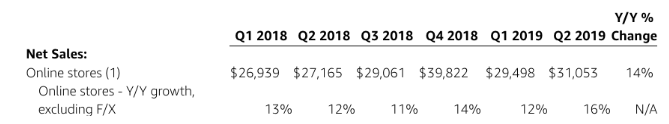

Despite these headwinds, Amazon stock is still a good bet going into a recession due to the diversification of the company’s revenue base. The revenue growth rate of its online stores’ segment has trailed other faster-growing segments like AWS and subscription.

Fig: Slower sales growth from online stores segment. Source: Amazon Filing

An economic slowdown can also have an upside for Amazon as it will see greater consolidation is several business segments in which it operates. The best example is video streaming where a large number of companies are looking to increase their investments to gain subscribers. However, if the subscriber growth does not match the expectation of these companies, we should see a consolidation or at least a big decline in competition for subscribers.

A slowdown can also open up new opportunities for acquisition. Amazon has a decent chunk of cash on hand. This will be useful to make purchases at great price within the physical retail segment.

Consequently, Amazon has some key advantages which should help the company survive and even thrive during a mild economic slowdown.

Investor Takeaway

Amazon’s three fastest segments contribute close to 50% of its revenue base. The growth in AWS, subscription, and advertising could suffer during an economic slowdown. But all these segments have a decent moat which should allow them to sustain themselves during a slowdown.

Amazon also has a lot of price flexibility in its e-commerce platform which should allow the company to retain its membership base. This makes Amazon stock a good mix of growth and defensive bet.

As of this writing, Rohit Chhatwal did not hold a position in any of the aforementioned securities.