After a jobs report that was mostly in line with expectations, investors bid up the market in relief. The question now is, can equities continue higher into earnings season? Let’s look at a few top stock trades.

Top Stock Trades for Tomorrow: Amazon (AMZN)

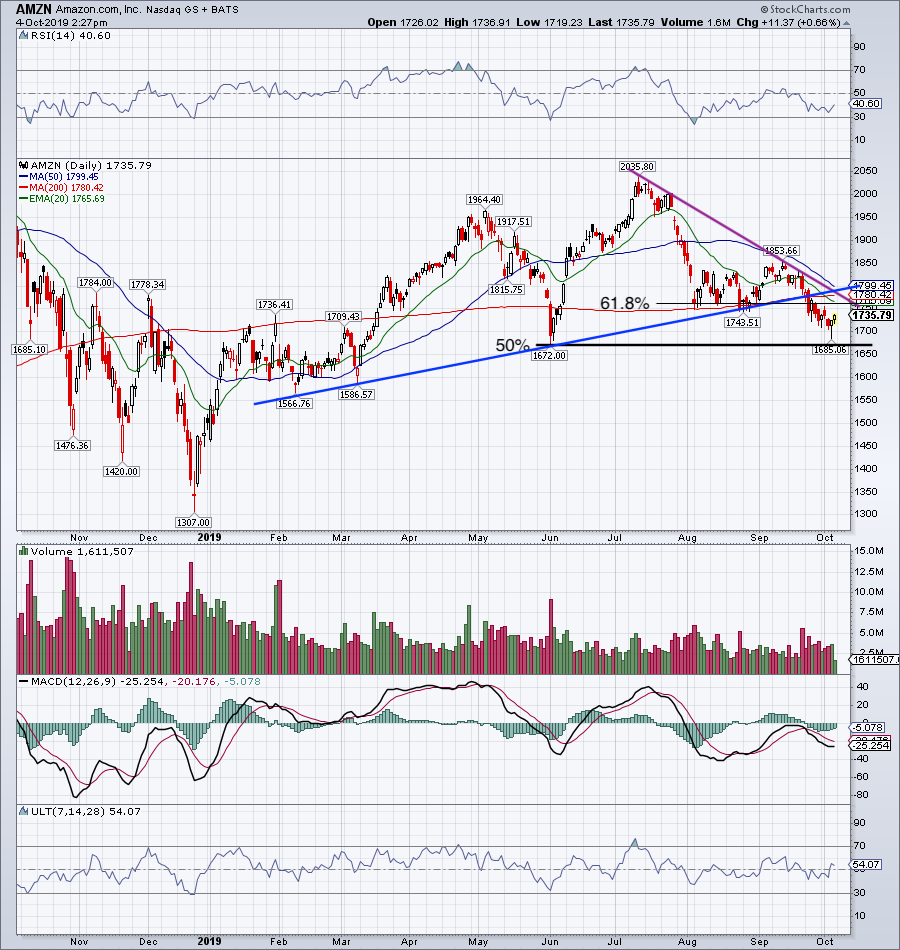

A look at the Amazon (NASDAQ:AMZN) chart does not inspire much confidence. Remember, it’s one of the least impressive FAANG stocks at the moment, as shares continue to struggle.

And now we enter the all-important fourth quarter. A glance at the charts shows us the breakdown below uptrend support (blue line), the 200-day moving average and the 61.8% retracement.

Luckily, InvestorPlace readers were ready for the decline. What now, though?

Shares almost tagged the lows from May, which also come into play near the 50% retracement. That area now becomes the must-hold spot for AMZN stock. Below there and the selling pressure can build.

Unfortunately, there’s a lot of overhead resistance between $1,750 and $1,800. I would feel better about buying AMZN on a deeper pullback or on a breakout over resistance than here at $1,735 hoping it continues higher.

Top Stock Trades for Tomorrow: Lululemon (LULU)

Shares of Lululemon Athletica (NASDAQ:LULU) have enjoyed strong gains through 2019. The stock has put in a series of higher lows along an uptrend support mark (blue line).

That rough line held earlier this week, as did the 50-day moving average. We now see LULU stock breaking out of the descending wedge (purple lines) that it has been in since its post-earnings pop to new all-time highs.

From here, let’s see if LULU stock can continue higher and get back to $200. If it can, new highs over $204.44 are possible.

Top Stock Trades for Tomorrow: Broadcom (AVGO)

Broadcom (NASDAQ:AVGO) and a number of other chip-makers caught a boost on Friday thanks to positive news from Apple (NASDAQ:AAPL). The company will increase its iPhone production by roughly 10% thanks to stronger-than-expected demand.

That benefits suppliers like Broadcom in obvious ways, and while some may wonder why we’re looking at AVGO instead of AAPL, it’s because our chart on Apple from Thursday is still in play.

As for AVGO, shares are making notable progress by reclaiming the 100-day and 200-day moving averages, as well as uptrend support (blue line). Shares have been trading sideways in a very wide wedge for months now, as investors wait for AVGO to resolve either higher or lower.

Near $280 it faces a trifecta of resistance, with the 20-day and 50-day moving averages, as well as the 38.2% retracement all in the same area. The silver lining is that it’s already reclaimed notable levels on the day.

So what’s the play? A move over $280 could send AVGO up to downtrend resistance (black line), while a close over $285 could trigger a run back to $300-plus. Below $270 should concern the bulls.

Top Stock Trades for Tomorrow: Skyworks Solutions (SWKS)

You may notice a very similar-looking wedge pattern taking hold in Skyworks Solutions (NASDAQ:SWKS), which also had a strong day. On Friday, SWKS reclaimed its 200-day, 50-day and 20-day moving averages, and is now trading just below its 61.8% retracement.

Over the 61.8% could send SWKS to downtrend resistance and possibly to last month’s high near $84.35. Above that puts $88.24 on the table, the high from July. Below $74 would be cause for concern.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell is long AAPL and AVGO.