Hiring is slowing, but the September employment report should be just solid enough — and not reflect anything near the onset of a recession.

But investors will be picking over the report, which is a signal for the health of both businesses and the consumer, to see where the weakness lies, and economists expect sectors impacted by trade to take a hit. The employment report is released at 8:30 a.m. ET Friday.

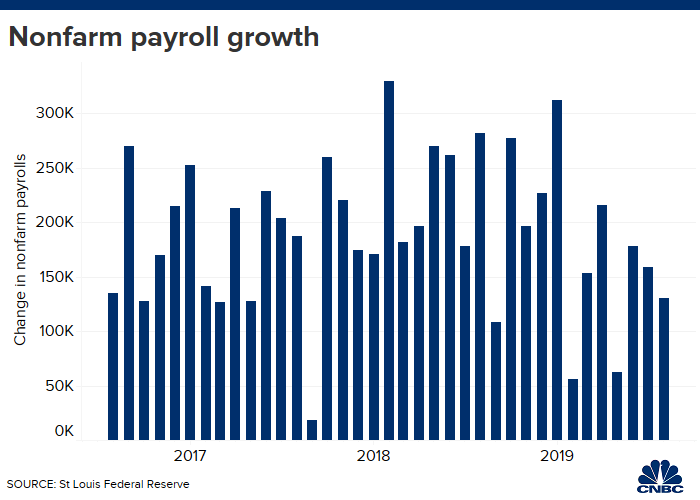

Economists expect the U.S. economy created 145,000 jobs in September, up from 130,000 in August, with unemployment holding at 3.7%, according to Dow Jones. Wages are expected to have risen by 0.2% in the month.

“It’s not a terrible number. It’s not a great number. We only need 100,000 to stabilize the unemployment rate,” said Diane Swonk, chief economist at Grant Thornton. Swonk expects 125,000 payrolls were added in September, and unlike some economists, she does not expect to see much impact from the government hiring of census workers for several months.

“We were growing at more than 200,000 [jobs] a year ago, and we’ve slowed consistently over the year. Some of it is we’ve run out of workers, and there are some soft spots, like manufacturing and retail,” she said.

ISM Manufacturing data, released earlier this week, showed a contraction in that sector for a second month, and sparked fears that a manufacturing recession could turn into a broader recession. ISM also released disappointing services data on Thursday, but the sector remained in expansionary territory.

Wilmington Trust chief economist Luke Tilley explained his view simply. If the trade war is ended, the economy will improve, but if the trade war continues and more tariffs are added, the economy will slow and fall into recession.

“If you get the escalation as scheduled right now, especially if you get the counter tariffs or whatever type of retaliation from the Chinese, we expect there would be a recession in 2020. Without that, we think the economy could go on for a couple of years” without recession, said Tilley.

Tilley also expects the economy added 125,000 jobs in September. “That’s still enough to be adding jobs to the economy but it will be a little deceleration,” said Tilley, noting the manufacturing sector could show a loss of jobs.

Swonk said the strike by GM workers may be behind some of that slowdown in manufacturing in September, but it is not yet showing up in the employment report. She too sees manufacturing job losses.

Leisure and hospitality is expected to add just 15,000 jobs, down from a trend of 40,000 to 50,000, she said. “It’s a labor market that is slowing. Its Achilles heal is manufacturing. I don’t think you’re going to have a lot of construction jobs either but it’s also running out of workers in some areas,” she said.

Barclays chief economist Michael Gapen said he expects 145,000 jobs were added in September.

“We’ve got evidence in the last couple of months that employment is slowing. We’ve got the first warning that employment growth is moderating and hours worked is soft,” said Gapen. “There’s renewed concerns about global growth and the health of the expansion…how much longer can consumption and services hold up in the face of that slowdown.”

Gapen said consumer spending showed its first crack last week, when it was reported that consumption gained just 0.1% in August. “The economy may be transitioning from a state of expansion to a stall speed outcome,” he said.

The slower job growth and weak manufacturing environment come as uncertainty is rising. For one, the impeachment process creates concerns about the ability of the government to take necessary actions, such as adopting a budget or avoiding a debt ceiling issue.

“It’s not hard to talk yourself into recession. It’s harder to talk yourself out of it…These affects snow ball and fear is a real factor,” Swonk said.