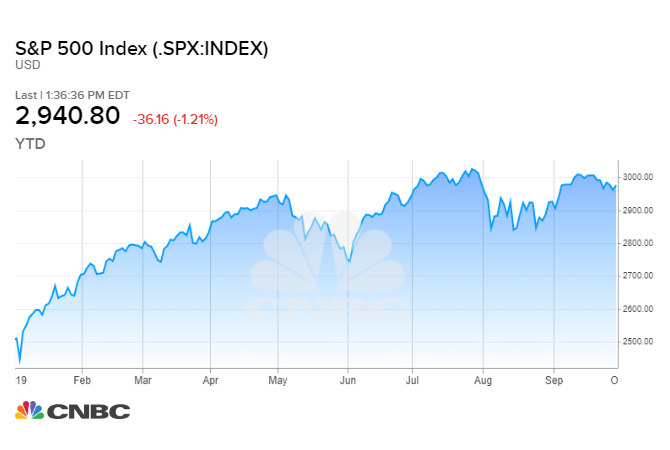

The fourth quarter got off to a rocky start as recession fears hit stocks, and technical analysts are warning that there could be more downside ahead.

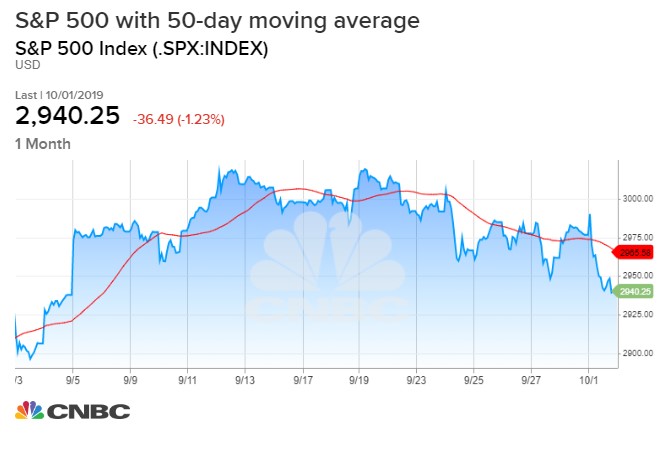

Stocks are poised to open Wednesday’s trading day in the red, which would be an acceleration of Tuesday’s sharp losses. The Dow fell 344 points and the S&P 500 broke below its 50-day moving average — a key technical indicator — after manufacturing data came in at its lowest level in a decade.

Ned Davis Research chief global investment strategist Tim Hayes remains underweight equities, pointing to a lack of breadth in the comeback in September, as well as slowing equity fund inflows and a failure of the yield curve to steepen. He says that this rally is becoming “another round of failure.”

“If the outlook was turning bullish for equities, we would see the major benchmarks breaking to record highs with decisive and broad-based confirmation from breadth indicators…We would see yield curves steepening,” Hayes wrote in a note to clients on Tuesday. He believes that all of these factors are “a reflection of waning confidence in the macro environment globally.”

The S&P falling below its 50-day moving average isn’t the only technical indicator breaking down, says MKM Chief Market Technician JC O’Hara. He believes “the market is not in the best shape to make new highs from its current position” since “shorter term technical indicators started to show some negative divergences.” Specifically, he points to the RSI indicator, which he says “started to roll over a week prior.”

“We believe more time is needed to allow those indicators to fully reset, and thus are in a better position to make new highs,” he said.

Hayes argues that the most recent rally has been uneven in nature, which could spell trouble ahead. He noted that not only have U.S. indices failed to regain July highs, but outperformance in large-cap stocks is masking signs of weakness in other areas of the global stock market.

“As the megacaps have been propping up the ACWI and other cap-weighted indices, underlying deterioration has been reflected by the equal-weighted ACWI,” he wrote, calling this divergence a sign of “mounting economic pessimism.”

The iShares MSCI ACWI tracks large and mid-cap stocks around the world.

Hayes also pointed to the bond market as a sign that the rally’s underlying fundamentals may not be supported, saying that if the overall outlook were positive “we would see yield curves steepening again.”

.1569955312604.png)

Softer stock ETF and mutual fund inflows is another sign, argues Hayes, that the market might be on the verge of turning a corner. In August investors pulled $46.2 billion from equity ETFs, according to ETF Trends, while $13.5B flowed into bond funds. O’Hara reiterated this point, noting that Tuesday stock inflows were light, which was a “negative signal” given that “historically inflows have been present at the start of each month.”

But not everyone on the Street shares Hayes’ view that stocks could be set for a pullback. Fundstrat Global Advisors’ Rob Sluymer wrote in a note to clients on Tuesday that investors should buy any weakness in “anticipation of further upside through Q4.”

Though many traders and analysts remained worried. On a more granular basis, The Tribeca Trade Group CEO Christian Fromhertz noted that individual sectors are beginning to show signs of weakness. “On the technicals, you’re losing breadth a little bit. You’re losing some groups. Health care is the next group to kind of watch that’s vulnerable. Sometimes it’s OK when you have a couple of groups that are weak … but we’re starting to see more groups tilt to the downside,” he said.

– CNBC’s Yun Li, Fred Imbert, and Tom Franck contributed reporting.