Strategists say the stock market should have a better fourth quarter after a range-bound third quarter, even with turbulence that could come from an impeachment inquiry and ongoing trade tensions with China.

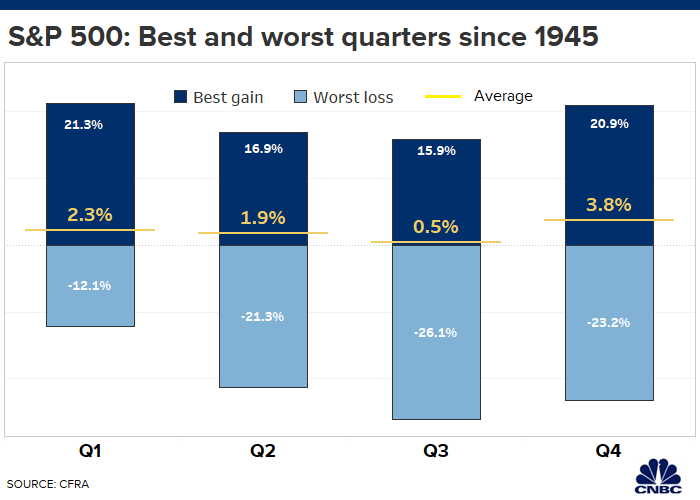

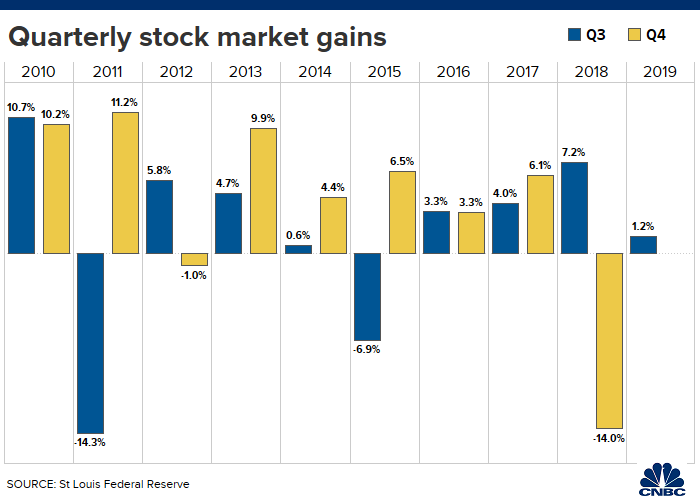

The S&P 500 ended the third quarter at 2,976 with a 1.2% gain, and it is now about 1.7% below the all-time high it reached during the quarter, on July 26. The fourth quarter is typically the best of the year, and since World War II, it has gained 3.8% on average and was higher 78% of the time, according to CFRA.

“It’s a bull with a lower case ‘b,'” said Sam Stovall, CRFA chief investment strategist. Stovall said about a 4% gain is possible by year end. Stocks have been tossed by trade worries, but supported by easing from the Fed and other global central banks.

.1569876214060.jpeg)

“I think [the fourth quarter] could actually surprise to the upside. It’s often good,” he said, noting last year’s sharp fourth quarter decline was an outlier. “October is usually pretty shaky. But November, December, you tend to have investors look to the coming year, not just focus on the rest of the quarter.”

Analysts say the market should be able to weather the impeachment inquiry, and even if the Senate takes it up, there’s little chance the president would be convicted by the GOP controlled body.

“I think it will make for good headlines but not affect the bottom line,” said Stovall. As for the election, it could also cause some bumps, with Sen. Elizabeth Warren closing in on front runner former vice president Joe Biden in the polls. “I think the more left leaning you get, the more likelihood the present administration sticks around,” Stovall said.

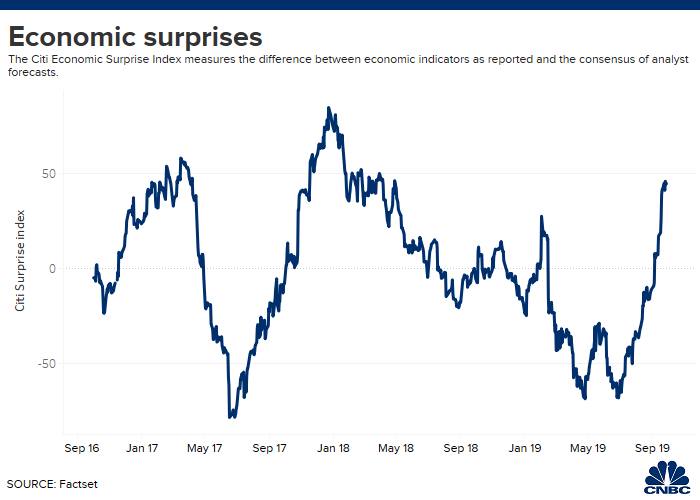

On the positive side, the economy is looking better than expected, earnings could therefore pick up, and the recession scare in bonds that drove interest rates sharply lower this summer is fading. Positive earnings surprises are outpacing negative, and when Citigroup’s surprise index picks up, it’s considered positive for stocks.

“I think earnings estimates are going to turn up. I think there’s a number of factors playing out. The fact a number of economic surprises have surged is saying we have a lot more positive economic momentum at the moment than we had earlier this year,” said James Paulsen, chief investment strategist at Leuthold Group. “That might start showing up in third quarter earnings reports.”

Paulsen noted that growth for the third quarter is now expected to be 2% or better, but earnings are still expected to show a decline. Third quarter earnings are expected to fall by 2.2%, according to Refinitiv. The second quarter was expected to be negative as well, but profits were up 3.2%, Refinitiv. For the fourth quarter, profits for S&P companies are expected to be up 4.1%.

Paulsen said he expects earnings to start showing a pick up within six months. “I think if earnings pick up, there’s considerable upside,” he said, noting that will could be the strongest drive for the market.

Analysts also expect a more positive view on the economy to show up in bond yields, which fell precipitously this summer in an extreme period of volatility for bonds. The 10-year touched 1.43% as September began, and it was at 1.66% Monday.

“You’re going to turn that falling yield thing from a real negative to a real positive,” said Paulsen. He said a real positive would be if it moves up above 2% and holds there, but it could spook stocks if it falls back below 1.6%.

Julian Emanuel, head of equity and derivatives strategy at BTIG, said it is likely the global bond bubble which drove rates lower in the summer has burst.

Emanuel said he expects investors will realize that the economy is better than they had believed during the summer, either from the economic surprises or because of the affects of Fed easing. “What could happen is a realization that the global situation is better than these incredibly low interest rates on the long end would lead one to believe,” he said.

Emanuel is less optimistic than some others about how much more the stock market can gain this year. His target puts the S&P 500 at 3,000 by year end and he says it can stay in a range for now that goes up to 3,030.

Many investors expect one more rate cut this year, but Emanuel does not. Disappointment over the Fed could create some volatility. Fed funds futures are pricing in a 42% chance of a quarter point rate cut in October.

“We don’t think the Fed is going to cut again this year because we think the economy is stronger than expected and if you look at inflation, it’s actually breaking out to the upside,” he said.

Emanuel said the better economy should help select stock groups, and when investors embrace cyclicals, the S&P will begin to break above its current range. Cyclicals, including financials, industrials, materials and energy were the top performers in September, with financials leading with a 4.5% gain.

Stock indices have been fairly subdued in September, as the market tried to regain the July high after August’s bond market turbulence.

“The S&P 500 in September 2019 didn’t have a single 1% drop and only two 1% gains. This normally volatile month could be passing some big moves to October this year,” notes Ryan Detrick, senior market strategist for LPL Financial.

“What has us worried this October is the fact that September this year was historically calm. If we know one thing, it is that markets don’t stay calm forever and after a dull market last month, we could be due for some usual October volatility,” according to Detrick.

The trade wars could break the calm, and they remain a wild card, with U.S. and Chinese officials expected to meet Oct. 10. Analysts say there are a variety of scenarios that could play out. For one, Trump could strike a quicker deal to score an economic victory while he’s under pressure from the impeachment process as he faces an election.

There’s also the view that China could drag its feet until the election, if it believes Trump has become more vulnerable. Another scenario is that China could actually seek an earlier deal if Sen. Elizabeth Warren takes the lead in polls, since she would have a different agenda than Trump and potentially be more difficult to strike a deal with.

There are also geopolitical events that could stir up markets. The U.K. government is trying to resolve Brexit, or its exit from the European Union in October, and the relations between Iran and the U.S. have become more tense after the attack on Saudi Arabia’s oil infrastructure.