VMWare’s (NYSE:VMW) meteoric rise after inking a key partnership a couple years ago just goes to show: “Data is the new oil.”

That phrase was first coined in 2006 by a British statistician named Clive Humby. He should know; he created the first supermarket loyalty card on behalf of Tesco (OTCMKTS:TSCDY). And with the data gleaned from that “Clubcard” program, the U.K. grocery chain doubled its market share from 1994 to 1995 alone. Talk about a valuable commodity!

These days, companies like VMWare are crucial in keeping this gravy train going. And VMW stock is up roughly 70% for us at Growth Investor.

The “VM” in “VMWare” stands for virtual machines, which is software that solves a big problem for many businesses: too many servers.

The more your company grows, the more data storage you need, but multiple servers quickly become a major headache – and costly. Instead, you can just log into VMWare, and do all your computing on one server. Things run faster and more efficiently, with less confusion. No wonder VMWare grew both earnings and revenue (+12% year-over-year) in the second quarter, both of which beat Wall Street expectations.

Now, these days, many companies don’t keep their own servers, or even rent space in a data center…they just use cloud (online) storage. Or they use some combination of the three. And when it comes to this “hybrid cloud,” VMWare has pretty much cornered the market.

That’s thanks to a historic partnership with one of my other Growth Investor picks: Amazon (NASDAQ:AMZN). You might think of Amazon more for online shopping, or to buy e-books for your Kindle. Well, these days, its biggest profit driver is actually Amazon Web Services (AWS).

VMWare was already a leader in the cloud computing field; it is the infrastructure platform choice of 100% of the Fortune 500. It also has strong marketing relationships with computer hardware vendors, like Dell Technologies (NYSE:DELL), HP Inc. (NYSE:HPQ) and IBM (NYSE:IBM). Now that this “private cloud” company has partnered with Amazon’s “public cloud” service, customers don’t need to choose.

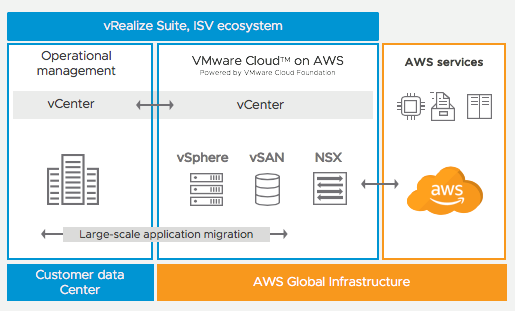

Below you can see VMWare’s products for your data center and for VMWare Cloud, plus Amazon’s own cloud services – and how they can all interact. For Big Data, VMWare and AWS is a “one-stop shop.”

Hospitals, banks, car companies, the Make-a-Wish foundation, even candy companies and colleges all use VMWare to make their data operations more modern (and thus more secure).

There’s just one final frontier for VMWare and AWS (and their customers): the “mother of all technologies.”

Crunching the Numbers

Up until now, technologies have certainly made our lives easier and more efficient…but with a lot of room for human error. People trip over cords, spill their coffee, and get tired.

Artificial intelligence (A.I.) does not.

As scientists find even more applications for artificial intelligence – from healthcare to retail to self-driving cars – it’s incredible to imagine how much data will be involved.

To create A.I. programs in the first place, tech companies must collect vast amounts of data on human decisions. Data is what powers every A.I. system.

So any one company that can help with customers’ data issues – is the one company that’s most worth investing in.

After all, in the 2003 oil boom, investors could either speculate on oil futures contracts… or they could have bought shares in Core Laboratories (NYSE:CLB).

Core did no drilling or exploration of its own. It provided technology to lots of companies who did. And as oil prices climbed from $30 per barrel in 2003 to $100 per barrel in 2008, Core’s customers had more money to spend on exploration. Along with that, CLB stock rose 1,100%…with less risk.

Now, picture an industry like Big Oil as a huge skyscraper with lots of offices. By buying stock in an individual oil company, it’s like having a key to one of those offices. By buying Core Laboratories, it’s like having a “Master Key” to all of them.

The A.I. “Master Key”

Core Laboratories was the Master Key to the 2000s oil boom. And here, the Master Key is the company that makes the “brain” that all A.I. software needs to function, spot patterns, and interpret data.

It’s known as the “Volta Chip.” Last week, VMWare just signed a big deal with this very company — and its Volta Chip is what makes the A.I. revolution possible.

Some of the biggest players in elite investing circles have large stakes in the A.I. Master Key:

- Ron Baron, billionaire money manager with one of the biggest estates in the Hamptons.

- Ken Fisher, author of The Ten Roads to Riches and other bestsellers, who’s made the Forbes 400 Richest Americans list.

- Mario Gabelli, namesake of the Gabelli Funds, with a salary of $85 million for one year — Wall Street’s highest paid CEO.

None of them, however, are programmers…or any kind of tech guru. You don’t need to be an A.I. expert to take part. I’ll tell you everything you need to know, as well as my buy recommendation, in my special report for Growth Investor, The A.I. Master Key. The stock is still under my buy limit price — so you’ll want to sign up now; that way, you can get in while you can still do so cheaply.

Click here for a free briefing on this groundbreaking innovation.

Louis Navellier had an unconventional start, as a grad student who accidentally built a market-beating stock system — with returns rivaling even Warren Buffett. In his latest feat, Louis discovered the “Master Key” to profiting from the biggest tech revolution of this (or any) generation. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.