It was a modest day in the stock market Friday, with U.S. equities rising slightly despite a jobs report that came up short of expectations. Here are our top stock trades from Friday.

Top Stock Trades for Tomorrow #1: Zoom Video

Shares of Zoom Video (NASDAQ:ZM) started off higher on the day, but quickly reversed and trended lower throughout Friday’s session. The move comes after the company reported earnings.

Discouraging as its breakdown is, it’s even worse that ZM stock failed to hold the vital $90 level. This spot has been support for months now.

If bulls can’t reverse ZM stock higher, the 20-day and 50-day moving average may act as resistance in the intermediate term, just as they did on Friday. On the downside, look to see if the 38.2% retracement near $80 can buoy the name.

Top Stock Trades for Tomorrow #2: GoGo

GoGo (NASDAQ:GOGO) stock has been robust over the past few days, rallying from $4 to almost $5 in just a few trading sessions. It’s now approaching the latter — $5 — which has been vital over the past year.

In the course of those few days, GOGO stock cleared the 20-day, 50-day and 200-day moving averages. If it can clear $5 and possible downtrend resistance, a move up to $6 surely isn’t out of the question.

If $5 is resistance, look to see if shares of GOGO find support at the 200-day moving average or the rising 20-day moving average — whichever comes first.

GOGO stock is starting to look attractive on a longer time frame, although it is still a speculative play.

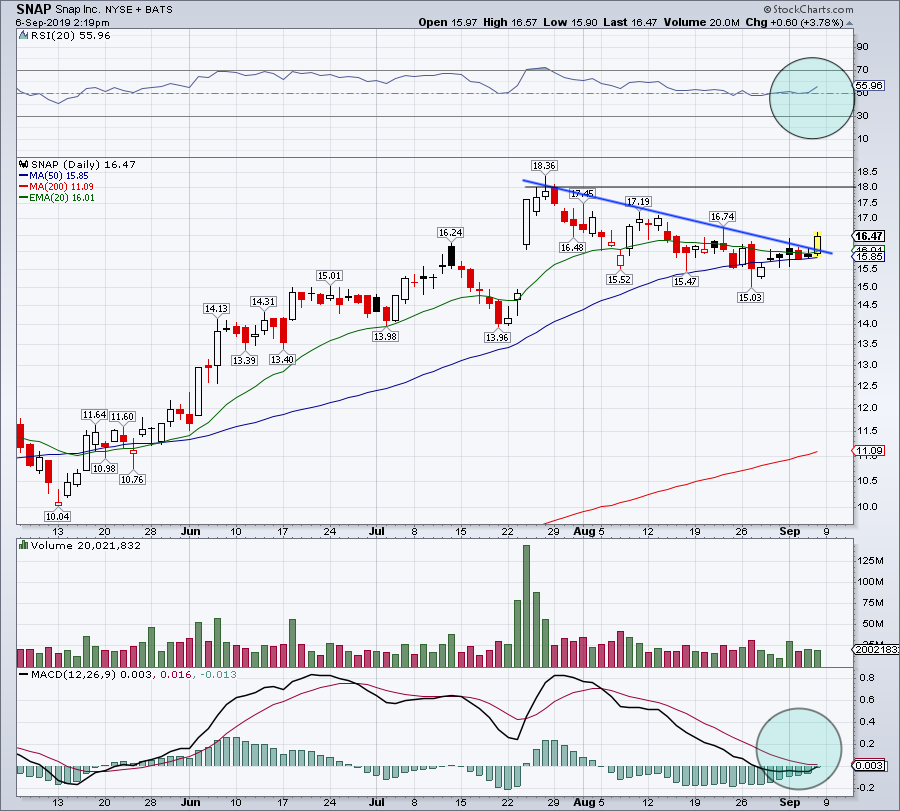

Top Stock Trades for Tomorrow #3: Snap

Snap (NYSE:SNAP) is shaping up as a real beauty here. After hugging its 50-day moving average, shares blasted over downtrend resistance (blue line). We also saw an explosion of call options in the October $20 strikes.

The MACD measure is turning in bulls’ favor, while the RSI is nowhere near overbought (blue circles). Bottom line? This one could run and the risk/reward is very defined. Traders may consider using a close below the 50-day moving average as their stop-loss.

If the markets cooperate, $18 shouldn’t be out of the realm of possibilities.

Top Stock Trades for Tomorrow #4: Pinterest

Pinterest (NYSE:PINS) hasn’t been looking all that healthy lately, falling from $35 last week to $30 at Friday’s lows.

Down five days in a row and right into support may entice some buyers, though. I know it enticed me — although I’ve been wrong before and will be again! I like Pinterest for the long-term and added to my long-term position on Friday.

Shares declined right into the 50-day moving average and the 38.2% retracement at $30.02. If this level fails as support, $29 will be on deck. If it does, look to see if PINS can reclaim $32 and get back above the 20-day moving average.

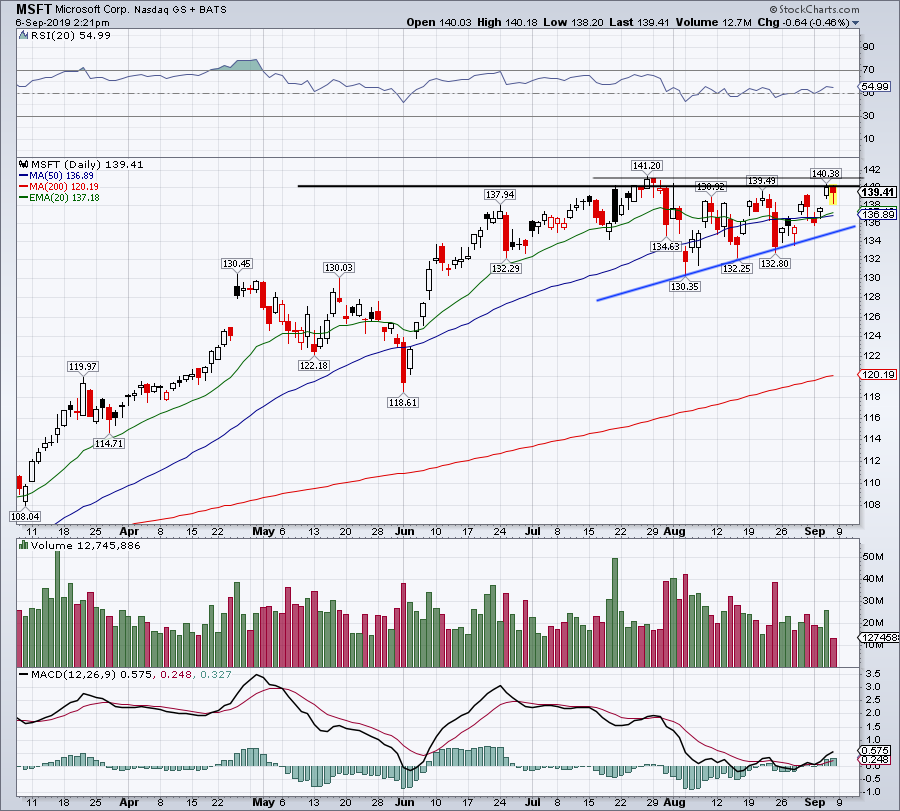

Top Stock Trades for Tomorrow #5: Microsoft

Microsoft (NASDAQ:MSFT) has been one of the more resilient mega-cap tech stocks out there and is still quietly commands the largest market cap among U.S. stocks.

Uptrend support (blue line) continues to squeeze MSFT into static resistance near $140. That describes an ascending triangle — a bullish technical setup. A move over $140 could easily send MSFT to $141.20. Over it and shares are in breakout mode again. Below $136 and the setup will start to fall apart.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell is long PINS.