Lyft (NASDAQ:LYFT) is more profitable than its earnings statements, reported on Aug. 7, let on at first glance. This might seem surprising, especially since LYFT stock reported losses during its second quarter of $644.2 million — up from $178.9 million in the same period last year.

But a close look at LYFT’s cash flow statements, not its income statements, shows that it was profitable for the first time during Q2 2019 on an operational cash flow basis.

Looking into LYFT’s Cash Flow Statements

LYFT has a large amount of non-cash expenses that it deducts from its GAAP earnings and reports on the Income Statement. Its “Statement of Cash Flows” adds those non-cash expenses back.

Cash flow statements reveal what really happens with a company’s cash during the period it covers. Often analysts and investors overlook this. LYFT’s profitability is also camouflaged by one more feature in the way companies report their cash flow statements.

Most companies, unlike Amazon (NASDAQ:AMZN) and a few others, do not report quarterly cash flows. They only report cumulative cash flows. So the quarterly cash flows have to be backed out by looking at several prior statements.

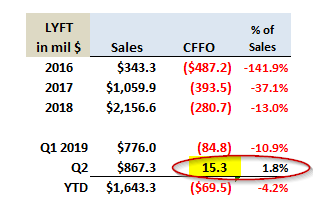

Here is what I found out. I compared the Lyft’s Cash Flow Statement for the period ending June 30, 2019, with the same for the prior quarter ending March 31, 2019. This showed that LYFT had a cumulative Cash Flow from Operations (CFFO) loss of $69.5 million for the six months ending June 30. But the prior quarter, Q1 2019, statements report that LYFT had a larger loss of $84.8 million.

That means that during Q2 the CFFO was positive $15.3 million ($84.8 minus $69.5 = 15.3). This represents 1.8% of sales. Moreover, the Q2 cash flow profitability has plenty of implications for LYFT’s forthcoming financial statements, especially in 2020. This will be valuable for the astute investor

The Future of LYFT Stock

First of all, LYFT has never before been CFFO profitable. The table below shows that LYFT been trending toward this cash flow profitability over the past year or so:

Second, we can use this to estimate what will happen in the third and fourth quarters, based on the outlook guidance that management provided in its latest earnings report.

For example, LYFT said that its 2019 sales should be between $3.47 and $3.5 billion. It also said that Q3 sales would be between $900 and $915 million. This means on average sales will be $907.5 million in Q3 and $934.2 million in Q4.

Given that LYFT’s gross profit — or what it calls “Contribution,” which is also calculated on a cash flow basis — was 47% of sales in Q2, CFFO can be estimated. I assume that most of the Contribution profit (about 87%) feeds into CFFO. Therefore CFFO in Q3, Q4 and also 2020 will be positive:

The table shows that in 2020, LYFT, for the first time will be profitable on a free cash flow (FCF) basis, after all its capital expenditures are deducted.

Being profitable on a cash flow from operations basis (CFFO) is not as significant as it might seem, at least at first glance. For example, it does not directly lead to a higher cash balance at the company. Capital expenditures first have to be deducted before the cash balance rise. However, most software and technology companies do not have very high capex requirements. That is because research and development is generally expensed. This comes out of net income. In addition, software expenditures that are capitalized, are usually one-time or controllable expenses.

That is why I estimated that 2020 would include just 4.4% of sales for capex spending, the same as in 2019’s first half. Using that estimate, LYFT will turn free cash flow positive sometime during 2020 or shortly thereafter.

At that point, the LYFT stock price will start to rise, assuming that the ride-share company continues to be cash flow positive.

Why Does This Matter?

The reason why this matters is because LYFT will not likely need to raise further capital. Since its operations are now cash flow positive and its capex spending can be controlled, it will likely be self-funding going forward.

This means shareholders don’t have to worry about any significant dilution to their shares. Furthermore, sometime in 2020 the LYFT stock price will start to reflect a good deal of optimism that LYFT is now free cash flow profitable.

What about Uber?

I looked briefly at UBER’s cash flow situation and found it is much worse off. For example, Uber’s contribution margin in Q2 was only 3% of sales, as opposed to LYFT’s 46% margin. More importantly, its cash flow from operations (CFFO) was negative, at 29% of sales. Lyft’s was positive 1.8% of sales.

The main difference seems to be that Uber stock generally has higher expenses levels, especially compared to sales, than Lyft.

When Lyft starts to become FCF positive, sometime next year, Lyft’s stock price will begin to outperform Uber’s stock.

Bottom Line on LYFT Stock

The net result is that if you own LYFT stock you should continue to expect good news in terms of the company’s operational cash flow profitability. When Lyft turns free cash flow positive and its net cash balance begins to increase sometime next year, LYFT stock will move upward in correlation with the extent of this cash flow profitability.

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities.