With trade-war “hope” fueling gains on Wall Street, some investors are skeptical the rally will last. After all, hope tends not to be a very dependable strategy. Given the big gains in stocks, there were plenty of other big movers on the day. Here are our top stock trades to watch going forward.

Top Stock Trades for Tomorrow #1: Micron

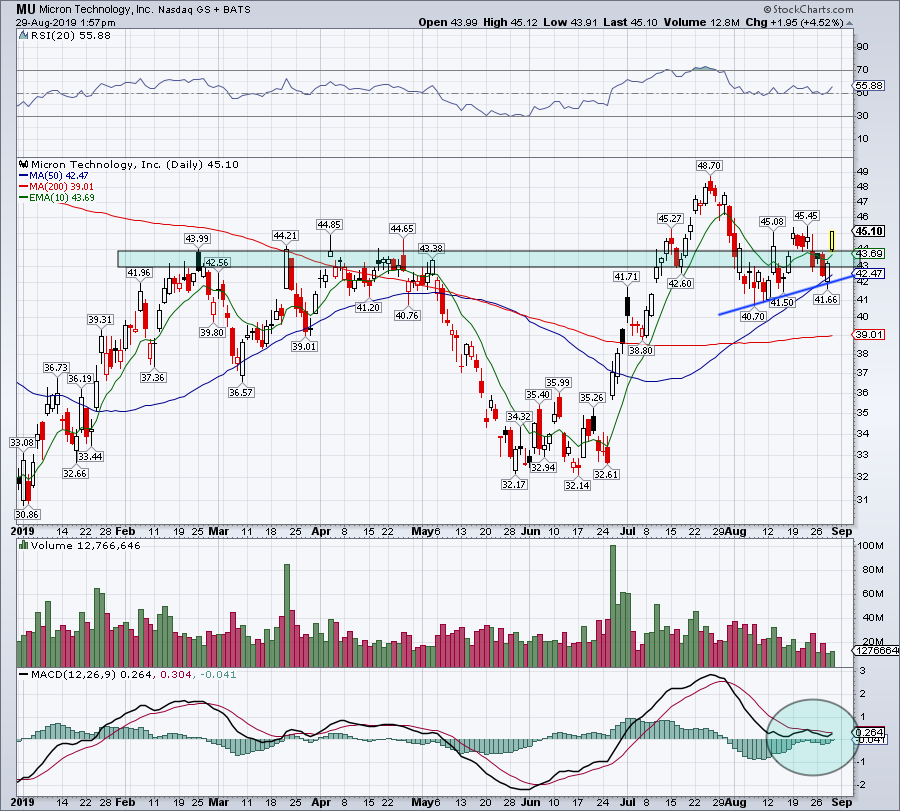

The $43 to $44 level has been stiff resistance for Micron (NASDAQ:MU). The fact that shares are gapping up and over this area is quite encouraging. Particularly given that trade war worries persist.

If the stock can clear the $45 level, it opens up July’s highs near $48.70 as a possible target. With the MACD measure (blue circle) turning positive, bulls could have some wind in their sails.

Below $43 and the setup is less appealing, and below $42 is completely falls apart.

Top Stock Trades for Tomorrow #2: Okta

Okta (NASDAQ:OKTA) stock reported a solid quarter, but shares are having trouble rallying.

Shares briefly rallied above the 20-day and 50-day moving averages, but failed to maintain above both measures. Bulls now need to see recent support near $125 hold strong.

Should it fail, Thursday’s low and the 100-day moving average will be next in line. Below the 100-day and OKTA will need more time to consolidate, while a move north of $135 reignites the bullish thesis.

Top Stock Trades for Tomorrow #3: Burlington Stores

Burlington Stores (NYSE:BURL) has been consolidating for about a year now, with Thursday’s 18% surge boosting the stock out of the range.

$180 had been a cap on BURL stock for quite some time, and it’s important that this former resistance level now acts as support should Burlington pullback in the future.

I would love to see shares maintain above short-term prior uptrend resistance (thin blue line) and continue to press higher. Going forward, see that the 10-week moving average acts as support too.

Top Stock Trades for Tomorrow #4: Guess?

Guess? (NYSE:GES) is also surging on the day, up almost 30%. Unlike Burlington though, GES is not breaking out of any ranges.

On the plus side though, it did surge through its 200-week and 10-week moving averages. Now let’s see if GES can add to its gains on Friday and close above the 50-week moving average.

If it can, downtrend resistance up near $21 is in the cards. If GES can’t push through the 50-week moving average, let’s see if the 61.8% retracement near $18.50 can buoy the name. Below and investors need to give it more time to firm up.

Top Stock Trades for Tomorrow #5: Ollie’s Bargain Outlet

Unlike GES and BURL, Ollie’s Bargain Outlet (NASDAQ:OLLI) is getting massacred, falling almost 30% on the day. Shares are now within spitting distance of the 200-week moving average.

Should it get there, it could attract buyers, at least for a short-term bounce. Further, at $51.50 it will be down about 50%, which may also be a sign for some investors that the losses are too large.

I’m not saying I’d leverage my mortgage to a long OLLI position, but if it sees $51 to $52 in the next few days, it could be a level for a dead cat bounce.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell did not hold a position in any of the aforementioned securities.