The fear-mongering media had quite a few factors to scare investors with last Friday: the U.S.-China trade war, President Trump’s latest tweets, and the plummeting S&P 500. Underneath the big selloff, would you ever guess that plenty of stocks made new 52-week highs that very same day?

No, I’m not talking about the good old “FANG” stocks – Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX) and Google (NASDAQ:GOOGL), which fell 2.4%, 3%, 1.8% and 3.2%, respectively.

In fact, the FANG stocks have been well off their highs for at least a month – if not 10 or 11 months!

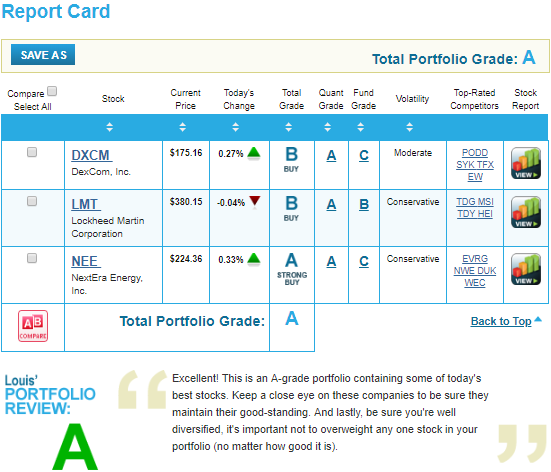

However, several of my stocks did hit new 52-week highs…including DexCom, Inc. (NASDAQ:DXCM), Lockheed Martin Corp. (NYSE:LMT) and NextEra Energy, Inc. (NYSE:NEE), one of my Top 5 Stocks in my Growth Investor service. A medical device maker, a defense contractor, and a power company…what a motley crew.

Well – what do these stocks have in common?

Take a look at how these companies measure up in my Portfolio Grader and I think you’ll spot the common thread:

Yep, this diverse group of stocks from different corners of the U.S. economy all earned an “A” for their Quantitative Grade.

That formula is one of the most important aspects of the stock-picking system behind Portfolio Grader. And it’s responsible for all the best wins of my investing career – so let me explain what I’m measuring here:

Essentially, a stock’s Quantitative Grade lets you know whether or not it is experiencing strong buying pressure. Simply put, I believe in “following the money.” If the “smart money” on Wall Street, like hedge funds and mutual funds, is pouring into a stock, that provides great momentum to keep the stock moving higher, all in itself. If the smart money is avoiding a stock – that’s a major red flag.

For example, most all of the FANG stocks currently have a “C” for their Quantitative Grade. Not terrible…but DXCM, LMT and NEE are simply better favored on Wall Street, as shown by their “A” grades. And the new 52-week highs demonstrate that.

Energy stocks, on the other hand, are racking up lots of “Ds” and even “Fs” for their Quantitative Grade. So, while many of them have juicy dividend yields, the incredibly weak stock performance cancels out that thesis for investing in energy at this time.

This all being the case…it won’t surprise you to learn that at Growth Investor, we’re largely avoiding energy. By focusing on companies with strong fundamentals, and popularity on Wall Street – even if they don’t receive much press – we’ve been able to ride stocks like DXCM, LMT and NEE to new 52-week highs, despite the volatile market.

In fact, at Growth Investor, we’ve enjoyed such strong relative performance that we haven’t had to sell any stocks in three months.

So would I recommend that you respond to the trade-war terrors by dumping your stocks? No.

I would recommend, however, that you choose your stocks very carefully. For example, you might not want a portfolio that’s overly exposed to Europe – given that President Trump has proposed tariffs on EU goods as well. While the “big fish” is Airbus (OTCMKTS:EADSY), the European rival to The Boeing Company (NYSE:BA), consumer staples like olive oil, wine and cheese may also incur the extra tax.

Tariffs or no, I say “buy American” is the way to go, anyway. When you get down to it, the United States is not only the country with the largest economy – but we also have some of the best growth prospects as well. At this point, countries from Sweden to Japan and even Germany are even willing to resort to negative interest rates to juice their growth. This is largely why global capital is pouring into the U.S. bond market…and the U.S. stock market has been the oasis for quite some time already, and clearly, it still is today.

As you see below, the S&P 500 (with its 14% year-to-date gain) is beating other global indexes by a mile.

Out of those 500 stocks – which becomes more like 5,000 when you factor in the whole U.S. market – how do we find the crème de la crème?

Well, I’ve got 3 urgent steps you should take today.

You already saw Step 1 earlier: “follow the money.” Click here for a free briefing with more of my timeliest advice to profit and protect yourself.

These days, if you want to invest with the “smart money,” you’ve got to have a healthy weighting in bulletproof stocks like my Money Magnets.

Not only did these stocks earn an A in my Portfolio Grader, thanks to strong buying pressure and great fundamentals…

The stocks also earn an A in my Dividend Grader. These stocks are able to pay great yields – and have the strong business model to back it up!

All in all, I’ve got 27 strong dividend growth stocks for you, almost all of which yield more than the S&P 500. These stocks are poised to do well as we continue to see international capital flow to the U.S. markets. Click here to see how I found these stocks, and how you can get great performance out of YOUR portfolio – come what may.

Louis Navellier had an unconventional start, as a grad student who accidentally built a market-beating stock system — with returns rivaling even Warren Buffett. In his latest feat, Louis discovered the “Master Key” to profiting from the biggest tech revolution of this (or any) generation. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters.