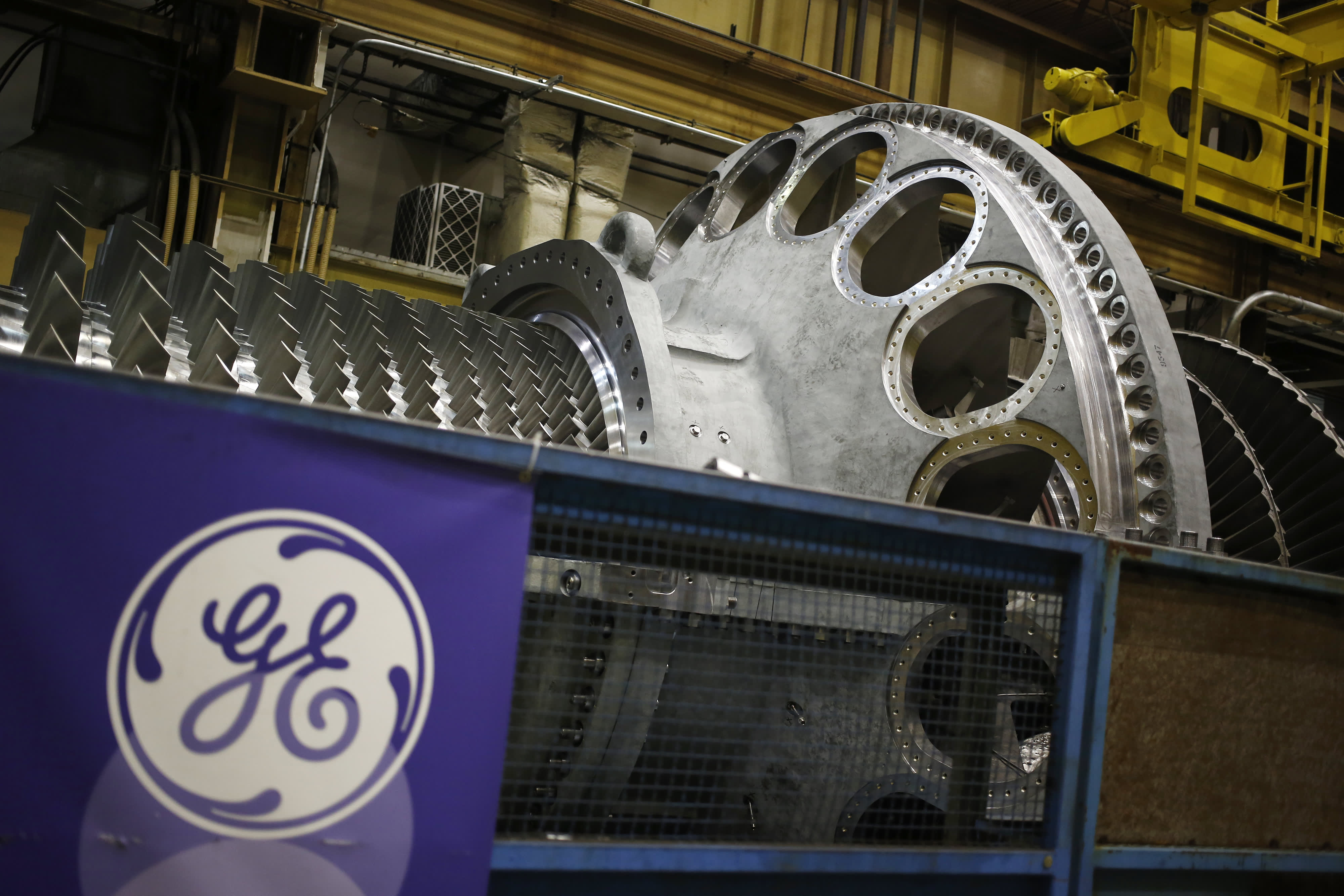

A logo is displayed next to a gas turbine at the General Electric Co. (GE) energy plant in Greenville, South Carolina, U.S., on Tuesday, Jan. 10, 2017. General Electric Co. is scheduled to release earnings figures on January 20.

Sharrett / Bloomberg / Getty Images

Check out the companies making headlines in midday trading.

Penn National Gaming — Shares of the casino company soared 12% after Penn National said it is buying a 36% stake in media company Barstool Sports. Penn National will pay about $163 million for an exclusive gaming and brand partnership with Barstool. The deal, which values Barstool around $450 million, is expected to close in the first quarter of 2020.

Apple — Apple shares rose nearly 3% to an all-time high on the back of better-than-expected quarterly results. The tech giant posted a profit of $4.99 per share on revenue of $91.8 billion. Analysts polled by Refinitiv expected earnings per share of $4.55 on revenue of $88.5 billion. Sales of the iPhone were a key driver Apple, raking in $55.96 billion in sales. That’s well above an estimate of $51.62 billion.

Dow — Shares of Dow are up roughly 5.2% after the company beat expectations on the top and bottom lines. The chemical and materials company posted an adjusted earnings per share of 78 cents for its fourth quarter and $10.204 billion in revenue. Analysts expected 74 cents in earnings per share and $10.071 billion in revenue, according to Refinitiv. The company said its cash provided by operating activities rose by $1.37 billion compared with the same quarter the previous year.

General Electric — Shares of GE rose nearly 10% in noontime trading, on track for their best day since October, after the industrial conglomerate reported fourth-quarter results above expectations. Earnings per share of 21 cents beat analyst projections of 18 cents, but investors were also pleased by GE’s 2019 industrial free cash flow of $2.3 billion. The figure, a measure of efficiency that had disappointed for consecutive prior quarters, topped the company’s own guidance. “We met or exceeded our full-year financial targets and are on a positive trajectory for 2020,” CEO Larry Culp said in a statement.

L Brands — Shares of L Brands soared more than 13% following a report from the Wall Street Journal that CEO Les Wexner is in talks to step aside. The report also said the company was exploring strategic options for Victoria’s Secret, its struggling lingerie brand. Wexner has ties to accused sex trafficker Jeffery Epstein, who died in jail last August.

Starbucks — Shares of Starbucks slid 2.5% as investors focused on its warning that the Wuhan coronavirus outbreak could “materially affect” its fiscal 2020 results. Starbucks has closed more than half of its Chinese locations as the country battles the spread of the virus. Executives said the Chinese locations that are still open have seen sales slow down.

Boeing — Boeing shares rose 1.5% as traders bet on the aircraft manufacturer despite gloomy fourth-quarter profit figures. Boeing booked its first annual loss in more than two decades to round out 2019. The company said it lost $636 million in 2019, its first annual loss since 1997 and a far cry from $10.46 billion in 2018. It also said its bill associated with the 737 Max crisis has risen to $18.6 billion, a combination of expected compensation to airlines whose fleets have been grounded as well as “abnormal production costs.”t

Facebook — Shares of Facebook gained nearly 2% ahead of its quarterly earnings report after the bell Wednesday. Raymond James upgraded the social media company to strong buy from outperform on optimism that it will beat earnings expectations. The firm said Facebook has less advertising related headwinds than expected. Raymond James also raised its price target to $270 per share from $230 per share.

AT&T — Shares of AT&T fell 3% after the telecommunications giant reported a quarterly revenue miss. AT&T missed fourth-quarter revenue estimates as another fall in subscriptions to satellite TV provider DirecTV overshadowed better-than-expected sign-ups in monthly phone subscribers. AT&T’s earnings beat estimates, however.

Advanced Micro Devices — Shares of AMD tanked 8% after the chipmaker offered a light revenue forecast for the current quarter with demand from video game console makers slowing ahead of the launch of new systems. AMD is calling for quarterly revenue of $1.8 billion, plus or minus $50 million, which is below the $1.86 billion Refinitiv revenue consensus.

Xilinx — Shares of the semiconductor manufacturer dropped around 10% after Xilinx issued weaker-than-expected revenue guidance for the current quarter. Xilinx expects revenue to range between $750 million and $780 million in fiscal fourth quarter. Analysts polled by Refinitiv expected guidance around $825 million in sales.

EBay — Shares of EBay dropped 2.7% after the e-commerce company gave a weaker-than-expected outlook. EBay said it expects first-quarter revenue to come in below analysts’ estimates as it faces fierce competition from Amazon and Walmart. The company beat on top and bottom line in its fourth-quarter results, however.

McDonald’s — Shares of McDonald’s rose nearly 2% after the fast food chain’s earnings beat Wall Street estimates. It reported earnings per share of $1.97 in the fourth quarter, compared to $1.96 expected, according to Refinitiv. Revenue was in line with expectations. The company’s results were boosted by price hikes as U.S. foot traffic declined.

— with reporting from CNBC’s Jesse Pound, Maggie Fitzgerald, Tom Franck and Fred Imbert.